NOTE: The following information is provided for entertainment purposes only. Use of any information is the responsibility of the user. Results may vary.

NOTE: This post contains affiliate links. I may be compensated for any purchases made through affiliate links.

Financial independence and early retirement haven’t come as easily as you thought, have they?

You’re told to get a job and invest in a 60% stock/40% bond portfolio for 40 years. Then hope you get the 8-12% annual returns your plan administrator says will make it work.

And yet, over that time horizon, some event or series of events will throw that plan off course. (Notice I didn’t say can. It’s a near certainty it will.) It’s a curse that doesn’t support your plans for your family.

A lot of people despair and want to tear down the system. But what if they’re just playing the wrong way in the system?

And what if you could play it better?

It’s not the system’s fault (entirely)

The “system” is meant to serve itself. Yes, people can get rich following it. And after a favorable market supporting our grandparents’ blue-collar jobs, it’s the easiest advice anyone could give.

Guess who also got rich during that time? The managerial class. The ones charging you fees to access those riches based only on a promise.

It’s in their interest to bring in more fees to put more money in their accounts. If the stock market is doing well, they don’t have to work so hard to get people to sign up. If not, they tell people to ride it out while still collecting fees.

All the while, hitting that expected 8-12% annual return means swinging between 20% losses and 40% gains.

The managerial class is set up to always win. It wasn’t set up for you to prosper in all seasons. Which is why you need to get smart about your options.

New routes await for those who look

If you’re going to get out of that hole with your finances, you need to adjust your equation. The equation is:

Money in x Growth rate = Your freedom

Admittedly, the money in part is getting harder. More and more high-income, white collar workers are losing jobs or stuck with more work at lower pay.

It took me over a year and a half to find the job I’m in now. That environment makes people pretty conservative about their prospects.

So today, I’ll focus on three ways to amplify that growth rate. For those of you with lower risk tolerance, it may push you past the expected 8-12% gains.

Take it as gospel or guide, but I can’t guarantee your results will look the same.

Option 1: Arrived Private Credit (8.38% APY as of publication)

A little more risk-on than a certificate of deposit at your local bank, but double the return.

If you’re not familiar with Arrived, they are turning real estate investing and loans into tradable securities. Instead of managing rentals yourself, they take care of buying, upgrading, marketing, and renting out single-family homes.

Arrived makes loans for new construction and rehab/renovation projects out of the Private Credit Fund. Recipients have to qualify and loans are secured with real estate, which protects you as an investor.

Yes, it is possible for a loan to default. But as of publication, they’ve completed 91 loans and have 56 active.

If you’re not familiar with real estate, the national market is undersupplied by millions of houses. Which leaves a lot of room for this to grow.

Check out their record and read the disclosures for yourself at arrived.com

Option 2: Angel Studios P&A (15%)

Do you remember when Sound of Freedom hit theaters? Angel Studios brought in over $120M at the box office. The film stayed at the #1 spot for several weeks until “Barbenheimer” knocked it off the throne.

And, incredibly, they did it on a $1M advertising budget. Only one million dollars!

What you may not know is that advertising budget was investor-funded. Through something called a Prints and Advertising offering, or P&A.

Like the Private Credit Fund above, this is a debt offering. You can lose your money if the movie flops.

But that comes with some benefits, too. These investors get paid first when the money comes back from the theaters. Historically within 2-4 months.

In total, Angel has funded advertising for 8 movies with full payouts. This year, they’ve paid out the full amount for Brave the Dark and King of Kings.

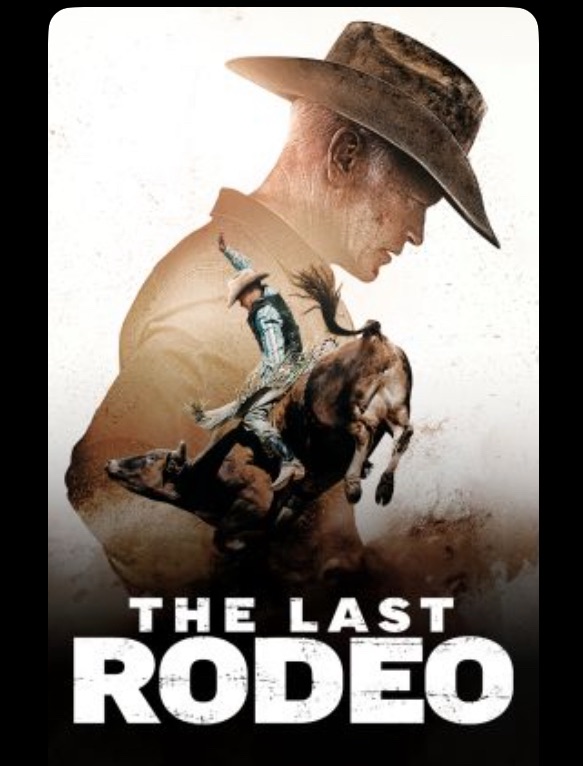

The box office numbers for The Last Rodeo look promising, too. And the funding round for Sketch just opened.

Check out more on their investor website at invest.angel.com

Option 3: Swing trading

If I’ve learned anything in my years of investing, it’s that markets will always correct. Stock values fly high until you fear missing out. Then you buy at the top, only to ride it down. All the while, you stress waiting for the market to come back.

But I’ve also learned that with the right tools, you can act on the market’s warnings when a trend change is on its way. Making the right moves at the right time raises your chances for double-digit gains in weeks to months.

I like swing trading better than income strategies like options wheel or vertical spreads. Opportunities don’t come around as often (maybe 1-2 per year), but they blow the returns out of the water.

You’re still using momentum to minimize risk, but you’re not beholden to making a little bit on a couple trades week by week. And you put in as much time working the same strategy.

I use VectorVest to help me get through the transitions and stay on the right side of trades. Yes, there are times you get false signals…especially all the way through 2022.

But using their timing indicators and screens, I’ve closed winning trades up to 65% since the April 23 trend reversal.

It’s more involved than the other two strategies, and definitely takes more discipline. But this jacks that growth rate into something manageable.

Check out more at VectorVest’s website. (NOTE: affiliate link)

Choose your own path

These are all things I’ve personally worked with. And, personally, they have changed the multiplier I’m working with.

I can only share my experience and let you know my results may be different from yours, but doing the research and the work is on YOU. Remember, only invest what you’re comfortable losing. If you need a refresher, refer to this article on position sizing.

The 60/40 portfolio is going to do whatever it will, which sometimes means correcting downwards and paying the managerial class regardless.

The important thing to remember is to control what you can and let go of what you can’t. So put effort into finding a path that will boost your equation and take the first step.

Taking care of a family is a broad endeavor. Subscribe today for updates on how to work with it all.

Check out these related articles before you go:

Leave a comment